SMM Alumina Morning Comment 6.23

Futures Market:On Friday, the most-traded ag2509 futures contract for alumina opened at 2,886 yuan/mt, reaching a high of 2,904 yuan/mt and a low of 2,873 yuan/mt, before closing at 2,899 yuan/mt, up 9 yuan/mt or 0.31%, with an open interest of 298,000 lots.

Ore Market:As of June 20, the SMM Import Bauxite Index stood at $74.43/mt, unchanged from the previous trading day; the SMM Guinea Bauxite CIF average price was $74.5/mt, unchanged from the previous trading day; the SMM Australia Low-Temperature Bauxite CIF average price was $70/mt, unchanged from the previous trading day; the SMM Australia High-Temperature Bauxite CIF average price was $61/mt, down $4/mt from the previous trading day, mainly due to a pullback in the price of Australian high-temperature bauxite compared to earlier periods.

Industry Updates:

(1) China's Alumina Imports and Exports: According to China Customs, in May 2025, China exported 207,800 mt of alumina, up 104.6% YoY; imported 67,500 mt of alumina, down 26.3% YoY; and had a net import of -140,300 mt of alumina. From January to May 2025, China imported a cumulative 167,000 mt of alumina, down 85.4% YoY; exported a cumulative 1.1723 million mt of alumina, up 79.4% YoY; and had a cumulative net import of -1.0053 million mt of alumina. (Based on 8-digit HS code: 28182000)

(2) According to SMM, starting from June 20, a large alumina refinery in Shandong adjusted the purchase price of 32% ionic membrane liquid caustic soda, reducing it by 20 yuan/mt from the base price of 800 yuan/mt; the ex-factory price under the two-invoice system was 780 yuan/mt (approximately 2,438 yuan/mt converted to 100% concentration).

(3) Bauxite Port Inventories: According to SMM statistics on June 20, the total bauxite inventories at nine domestic ports amounted to 22.08 million mt, down 570,000 mt from the previous week.

(4) Bauxite Shipping Data: According to data on June 20, the total weekly bauxite arrivals at domestic ports were 4.2009 million mt, down 38,000 mt from the previous week; the total weekly bauxite port departures from main ports in Guinea were 3.0638 million mt, down 1.0108 million mt from the previous week; the total weekly bauxite port departures from main ports in Australia were 1.3243 million mt, up 286,900 mt from the previous week. The rainy season in Guinea generally lasts from May to November, with more significant impacts in July and August. As we enter late June, the impact of Guinea's rainy season on shipments is expected to gradually become evident.

(5) Bauxite Imports in May 2025: According to the General Administration of Customs of China, in May 2025, China imported 17.514 million mt of bauxite, down 15.32% MoM and up 29.43% YoY. By country, imports from Guinea reached 13.223 million mt, down 20.97% MoM and up 40.65% YoY; imports from Australia totaled 2.96 million mt, up 10.44% MoM and down 17.81% YoY; the total volume of non-mainstream bauxite imports amounted to 1.331 million mt.

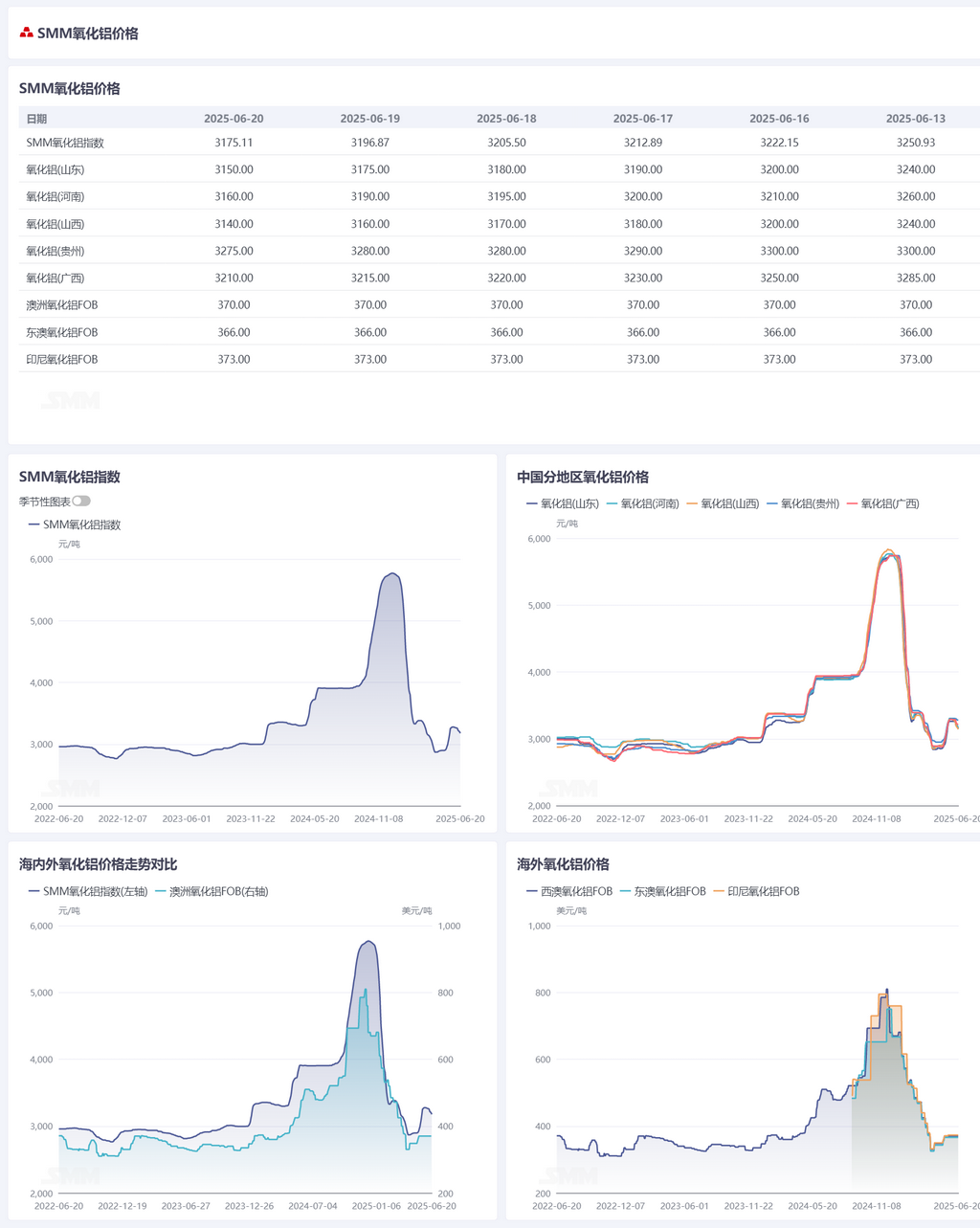

Basis Daily Report: According to SMM data, on June 20, the SMM alumina index was at a premium of 273.11 yuan/mt against the latest transaction price of the most-traded contract at 11:30 a.m.

Warrant Daily Report: On June 20, the total registered volume of alumina warrants decreased by 6,295 mt from the previous trading day to 42,900 mt. In Shandong, the total registered volume of alumina warrants remained unchanged at 0 mt from the previous trading day. In Henan, the total registered volume of alumina warrants remained unchanged at 0 mt from the previous trading day. In Guangxi, the total registered volume of alumina warrants decreased by 300 mt from the previous trading day to 2,701 mt. In Gansu, the total registered volume of alumina warrants remained unchanged at 0 mt from the previous trading day. In Xinjiang, the total registered volume of alumina warrants decreased by 5,995 mt from the previous trading day to 40,200 mt.

Overseas Markets: As of June 20, 2025, the FOB Western Australia alumina price was $370/mt, with an ocean freight rate of $22.60/mt, and the USD/CNY selling rate was around 7.20. This price translates to approximately 3,275 yuan/mt for the external selling price at major domestic ports, which is 100.19 yuan/mt higher than the domestic alumina price. The alumina import window remained closed.

Summary:

Last week, some alumina refineries completed maintenance and resumed production. Meanwhile, considering ore costs, there were new reports of production cuts. The operating capacity of alumina refineries saw both increases and decreases. Overall, the operating capacity of alumina refineries decreased by 440,000 mt/year MoM to 88.57 million mt/year last week. Spot supply remained loose, and the total inventory of alumina at aluminum smelters increased by 8,600 mt to 2.655 million mt last week. In the short term, the alumina fundamentals are expected to maintain a relatively loose pattern, and spot alumina prices are expected to pull back slightly. Follow-up attention should be paid to the capacity changes of domestic alumina enterprises and their profitability.

[The information provided is for reference only. This article does not constitute direct advice for investment research decisions. Clients should make decisions cautiously and should not rely on this as a substitute for independent judgment. Any decisions made by clients are unrelated to SMM.]